One of the first ERP solutions I implemented for a client about a decade ago was NetSuite . The company was past its infancy stage at that time but was still going through growing pains and was yet to become a public company. When the company filed to go public in 2007, I read its lengthy S-1 filing with great interest.

The IPO was well received as discussed in this article I wrote about the company in 2008. The timing of the IPO right before we ran into a generational bear market during the great recession was unfortunate as the stock declined from an intraday high of $45.98 on the day of its IPO to a low of $6.65 in January 2009.

The company did very well over the next seven years and the stock turned out to be more than a 10 bagger during that period. At the time NetSuite went public Oracle’s Larry Ellison owned 74.1% of the company and now owns nearly 40% of the company. When Oracle offered to acquired NetSuite for $9.3 billion or $109/share in cash, the negotiations for the deal were led by a committee of independent directors and required a majority of shares not owned by Mr. Ellison’s family to be tendered. This was done to avoid any conflicts of interest since Mr. Ellison is the largest shareholder of both companies. The second largest shareholder in NetSuite after Mr. Ellison is the asset management company T. Rowe Price with a nearly 18% stake in NetSuite.

Oracle’s offer to acquire NetSuite for $109/share works out to a valuation of 10 times sales but T. Rowe Price is holding off a price of $133 per share, which works out to 12 times sales. T. Rowe Price’s expectation is not off the charts as other cloud companies that are about the same size as NetSuite or in some instances larger than NetSuite including Workday and ServiceNow trade for 12.5 times and 11 times sales, respectively. However NetSuite has been around much longer than those companies and is not growing as fast as them.

Oracle decided to extend the deadline to tender shares to November 4th but doesn’t want to increase its offer for NetSuite. Oracle’s CEO Mark Hurd was on CNBC last week and reiterated that Oracle will not increase their offer and the final deadline is November 4th.

NetSuite was one of the companies Salesforce was considering acquiring according to information found in a hacked email from Salesforce board member and former Secretary of State Colin Powell as mentioned in my previous article discussing Salesforce’s target list for acquisitions. Due to Mr. Ellison’s large stake, another competitor like Salesforce would have a tough time getting majority approval for the deal.

There are a few ways this situation can play out:

1. T. Rowe Price folds and accepts Oracle’s offer.

2. Oracle decides that growing its cloud revenue is critical and that it is willing to pay up to continue its growth through acquisitions strategy.

3. They sit down and hash out a price somewhere between 10X and 12X revenue.

4. The deal falls apart and NetSuite is left at the altar an aging bride.

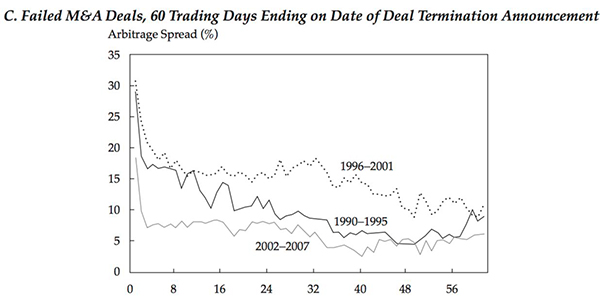

The stock has been declining almost continuously for several days now and dropped another 3.35% today to $90. This implies a potential profit of 21% or over 128% annualized according to our Merger Arbitrage Tool if the deal closes by the end of the year at the agreed upon price of $109/share. The market is often right and the recent decline in the stock price does not bode well for the deal. According to the paper The Shrinking Merger Arbitrage Spread: Reasons and Implications published in the Financial Analysts Journal in 2010, the spread for failed deals generally tend to increase in the 60 days prior to termination as you can see from the following chart.

If the deal falls through, the stock is likely to settle between $75 and $80/share, which is where the stock was trading before rumors of the deal started leaking. The upside on the deal is $19/share and potentially higher if Oracle comes back with a higher offer, while the downside is potentially between $10 to $15/share.

It is often said that investing is probabilistic. If the probability of this deal going through lies between 60% to 70%, then this could be considered a good bet. A recent Barron’s article pegs the probability of the deal going through at 63% while my highly subjective personal assessment pegs it closer to 70%.

We will have front row seats to see how this plays out in just a matter of days. If you decide to pay the price of admission, consider protecting your downside by either using call options instead of a long position or buying protective put options.