Salesforce’s first vertical-only cloud offering is one year old, and the company used a Dreamforce keynote to celebrate its first year’s success with two customer case studies, and lay out the roadmap for the future

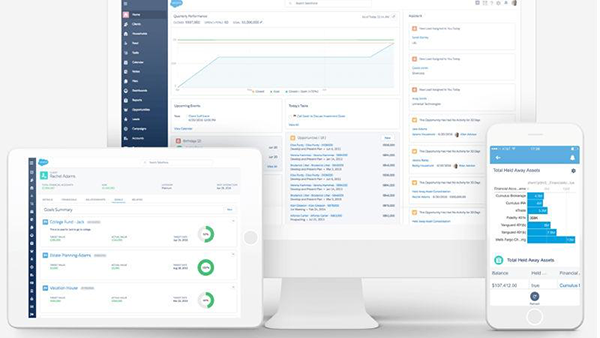

Salesforce launched Financial Services Cloud as its first vertical-specific customer relationship management (CRM) product in August last year, giving it a full year to form its plans for the platform and collect some customer case studies during Dreamforce this week.

Rohit Mahna, general manager of financial services at Salesforce, said Financial Services Cloud was built to solve “big, complex, industry problems” across banking, wealth management and insurance.

He expanded a little, saying: “In banking everyone is thinking about getting this 360-degree view of customers to become trusted advisors. In insurance it is about the policy holder and creating a seamless claims experience. In wealth management we help teams create a ‘one team’ mentality to get time back to spend with clients.”

Personalisation

The key here is personalisation. As Mahna said: “How do we bring that high touch personalised experience across the entire enterprise? Because customers are getting that level of interactivity outside of industry.”

The answer is, unsurprisingly, data. In comments that are even more relevant following Salesforce’s recently failed bid to buy the professional social network LinkedIn, Mahna said: “Your customers are broadcasting signals on a daily basis in industry, these are in transactions and things they are posting publicly.

“Just imagine the signals they are sending on LinkedIn, maybe they have changed their job. These are things we need to be capturing in real time and bringing them into our enterprise and analysing this.”

Salesforce Einstein for Financial Services Cloud

This is where Salesforce Einstein comes in, by providing an underlying artificial intelligence layer to push predictive recommendations to agents, bankers and wealth managers.

“We need to be using intelligence to spot patterns and make the right recommendations, when we should be interacting and in which channel. It is all about connecting at the right time,” Mahna said.

Mahna gave four use cases that Financial Services Cloud users can perform with the new AI powered Einstein capabilities:

“It means our relationship managers are able to discover relationships among the clients in their books they didn’t know about before.

“Marketing teams can make predictions based on predictive scores so they will know when a customer is likely to buy something.

“A recommendation engine, this is the idea of a coach so you’re relationship managers are coached on the next thing to do to keep customers on their personal and financial journeys.

“Automation, so everything those relationship managers do on a daily basis, the pen and paper jobs need to be automated so they get time back to spend with clients.”

Customer case study: Bank of America

Mahna then introduced two large launch customers to talk about Financial Services Cloud. The Bank of America case study is particularly relevant to the personalisation drive mentioned earlier.

Charlie Richey, head of product at Bank of America said: “We pay attention to the data we have access to, so transactional data like if their pay cheque deposits are rising, and listening on social channels like LinkedIn to see if they got a promotion.”

By pulling this information into Marketing Cloud, Bank of America can start to deliver tailored messaging to, say, enter their rewards programme, or increase monthly deposits into a savings account.

If the client shows interest in these offers a new lead is created and directed to a relationship manager who will be given a lead score for that opportunity and some suggested follow up options that align with that customers preferred contact methods.

Case Study: Farmers Insurance

Major US insurer Framers is another launch customer, and they rebuilt their claim submission app with Salesforce App Cloud and Community Cloud, which allows their 19 million policy holders to file a claim quickly.

If the customer come across any issues during the claims process they can contact a customer service agent via video conference within the app using Service Cloud. Customers then get push notifications to see the progress of their claim, with all of this data feeding into the Salesforce CRM so that agents can deal with claims quicker.

Agents subsequently get a fuller view of their customers and, by using the predictive analytics capabilities Einstein brings, can pre-empt their propensity to purchase additional cover or to push relevant marketing materials to avoid customer churn.

For example, Salesforce says it can track a customer’s shopping habits, such as the purchase of a new car, and alert agents so that they can push products like car cover. Using the new predictive lead scoring this would rank as a high probability lead within the Salesforce CRM.

Conclusion

Expanding into vertical specific products is a key part of chief operations officer Keith Block’s master plan for reaching a $20 billion run rate at Salesforce, with Block saying during the keynote that Financial Services Cloud is “just the tip of the iceberg.”

These vertical specific clouds may be the same old CRM wolf dressed in sheep’s clothing, but the difference is the vendor is now speaking the language of big enterprise customers in these industries who are looking for innovative ways to engage and retain customers without having to rebuild their infrastructure or put the kind of account management work in which is normally reserved for elite customers.